The "One Big Beautiful Bill Act" (OBBB Act) allows eligible taxpayers to deduct up to $10,000 annually in interest paid on a qualifying auto loan for tax years 2025 through 2028.

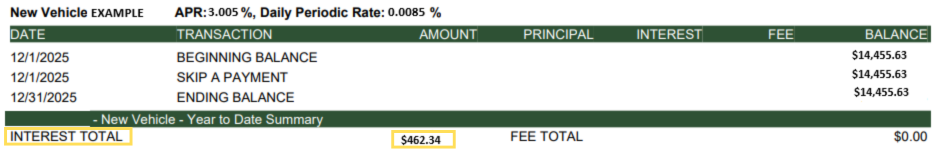

To find your 2025 interest total, view your December 2025 statement. Navigate to your New Vehicle - Year to Date Summary on your statement. There you will find a line item of your 2025 interest total.

To qualify for the deduction, both the buyer and the vehicle must meet specific criteria:

- Vehicle Criteria:

- The vehicle must be new (original use must start with the taxpayer). Used vehicles or leases do not qualify.

- The vehicle's final assembly must be in the United States. You can verify this on the vehicle's window sticker or by using the VIN decoder tool on the NHTSA website.

- The vehicle must be under 14,000 pounds gross vehicle weight rating (GVWR).

- Loan Criteria:

- The loan must be for the purchase of a qualified vehicle and secured by a lien on that vehicle.

- The loan must have been originated after December 31, 2024.

*This information is for educational purposes only and does not constitute tax or legal advice. Please consult a qualified tax professional for recommendations tailored to your specific situation.